The Institutional Flood: How Record Bitcoin ETF Inflows Are Rewritting the 2026 Market Structure

The Flood Begins

Bitcoin has crossed a threshold that can’t be undone. What was once dismissed as a speculative experiment has now become institutional infrastructure — a settlement layer, a reserve asset, and a structural allocation inside the portfolios of the world’s largest financial actors. The last twenty days have made this transition undeniable.

The flows tell the story.

Across this short window, U.S. spot Bitcoin ETFs have absorbed record levels of capital, pulling in billions in net inflows and setting multiple single‑day records. These aren’t emotional retail surges or hype‑driven spikes.

These are deliberate, programmatic, compliance‑approved allocations from institutions that move slowly, think in decades, and only act when the structural case is overwhelming. Their behavior signals a shift far more important than price action:

"Bitcoin is being integrated into the machinery of global finance."

This article begins at the moment the flood became visible — when inflows accelerated beyond historical norms and revealed a deeper truth about the 2026 market structure. The story is not about Bitcoin “going up.” It’s about why it’s going up, who is driving the movement, and how these flows are rewriting the architecture of supply, liquidity, and long‑term price discovery.

The thesis is simple: record ETF inflows are not a market reaction — they are a market redesign. They are reshaping how Bitcoin trades, who controls supply, and what the next decade of accumulation will look like. The sovereign individual and the sovereign institution are now converging on the same asset, but for very different reasons.

And that convergence is the real story.

The Numbers Behind the Surge

The last twenty days have delivered one of the strongest data‑driven confirmations of Bitcoin’s institutional transition. The inflows aren’t abstract. They’re measurable, timestamped, and verifiable across multiple independent sources — the kind of hard data that separates narrative from reality.

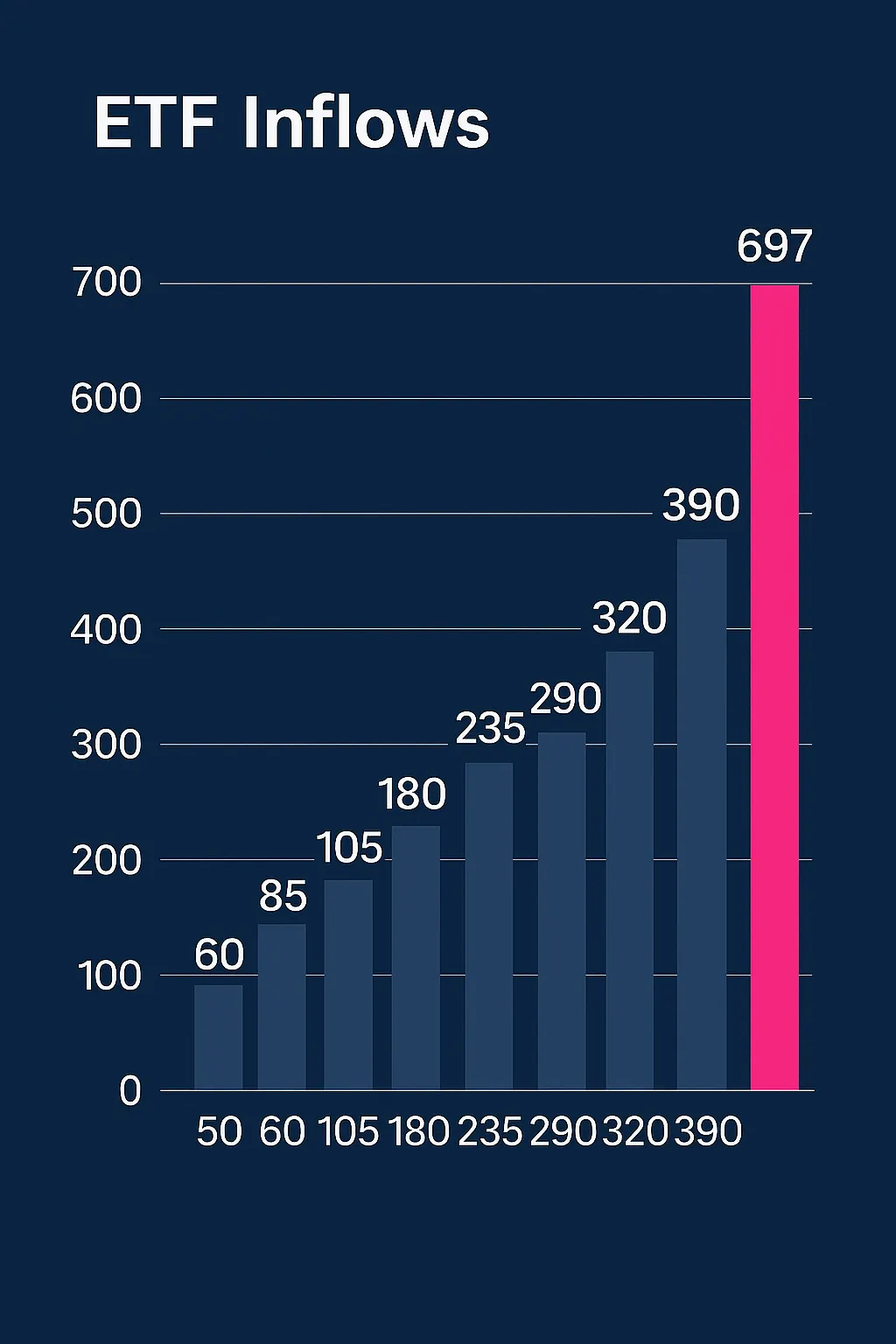

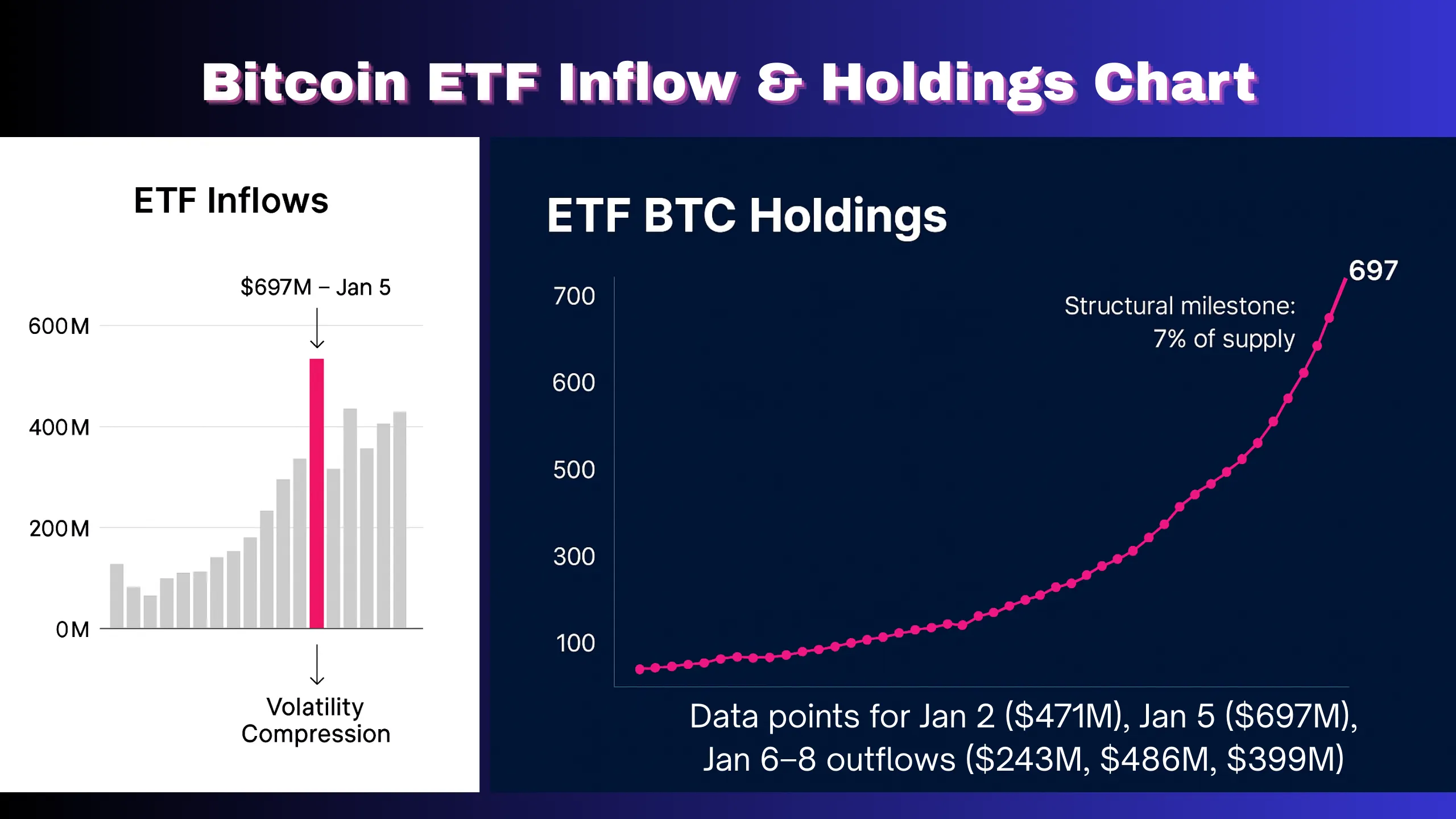

According to SoSoValue’s ETF flow tracker and reporting from 99Bitcoins, U.S. spot Bitcoin ETFs recorded $1.17 billion in net inflows across just the first two trading days of 2026 (January 2 and January 5). That alone would be notable. But the composition of those flows is what makes the signal impossible to ignore.

On January 5, ETFs absorbed $697 million in a single session — the largest daily haul of the year and one of the strongest since the products launched. This wasn’t a one‑off spike. It was part of a multi‑day accumulation streak that pushed total inflows for the period into multi‑billion‑dollar territory.

Even the outflows tell a story.

On January 6, the market saw a $243 million outflow, driven primarily by profit‑taking and short‑term repositioning. Yet the very next sessions reversed the move, with inflows resuming and quickly overpowering the dip. This pattern — brief outflows followed by stronger inflows — is characteristic of structural demand, not speculative churn.

The distribution of flows across issuers reinforces the trend.

BlackRock’s IBIT, Fidelity’s FBTC, and Ark/21Shares ARKB continue to dominate, collectively pulling in the majority of new capital. These are not fringe players. These are the largest asset managers in the world, allocating client capital into Bitcoin with the same operational seriousness they apply to equities and bonds.

Today, spot Bitcoin ETFs collectively hold roughly 7% of the entire Bitcoin supply — a structural milestone that would have been unthinkable just two years ago. Every inflow tightens supply. Every inflow shifts ownership. Every inflow rewrites the market structure.

This is the foundation for everything that follows.

Why Institutions Are Moving Now

Institutions do not chase narratives. They respond to structural conditions. When capital allocators of this size move, it’s because the environment has shifted in ways that make inaction riskier than participation. The surge in Bitcoin ETF inflows over the last twenty days is not a coincidence — it’s the result of multiple macro forces converging at the same moment.

The first driver is the global liquidity cycle.

After two years of tightening, markets are entering a phase where rate expectations are stabilizing and capital is rotating back into long‑duration assets.

Bitcoin, with its fixed supply and increasingly predictable demand profile, becomes an attractive hedge against monetary expansion and geopolitical uncertainty. Institutions aren’t buying Bitcoin because it’s volatile; they’re buying it because everything else is.

The second driver is infrastructure maturity.

Custody, compliance, insurance, and regulatory clarity have all reached a threshold that removes the operational friction that once kept institutions on the sidelines. ETFs eliminate the need for direct Bitcoin handling, allowing capital to flow through familiar rails. For institutions, this is not a leap of faith — it’s a process upgrade.

The third driver is psychological.

Bitcoin has survived every stress test thrown at it: regulatory pressure, exchange collapses, macro shocks, and internal governance debates. Each survival event strengthens its credibility as a long‑term asset. Institutions are not reacting to hype; they’re reacting to resilience.

Finally, there is the competitive pressure.

Once a few major asset managers begin allocating, the rest must follow. Underperformance is a career risk. Ignoring Bitcoin is no longer neutral — it’s a liability.

Institutions are moving now because the cost of waiting has become greater than the cost of entering. The sovereign individual saw this years ago. The sovereign institution is just catching up.

How ETF Inflows Reshape Market Structure

ETF inflows don’t just push price — they rewire the underlying mechanics of how Bitcoin trades, circulates, and is owned. Market structure is the hidden architecture beneath every chart, and over the last twenty days, that architecture has shifted in ways that will define the next decade of Bitcoin’s evolution.

The first structural shift is supply absorption.

Spot Bitcoin ETFs operate as one‑way valves: once Bitcoin enters these vehicles, it is effectively removed from active circulation. ETFs don’t trade in and out like retail participants. They accumulate, hold, and rebalance on long horizons. Every billion dollars of inflows tightens the available supply, reducing the float that market makers and exchanges rely on to maintain liquidity.

“This is why inflows matter more than headlines — they permanently alter the supply landscape.”

The second shift is liquidity concentration.

As ETFs grow, they centralize liquidity into regulated, institutionally managed pools. This changes who sets the tone for price discovery. Instead of retail exchanges driving intraday volatility, ETF flows begin to anchor the market. When BlackRock or Fidelity absorbs hundreds of millions in a single session, it creates a gravitational pull that smaller actors cannot counter. Liquidity becomes deeper, more predictable, and less sensitive to emotional swings.

The third shift is volatility compression.

Institutions don’t panic‑sell. They don’t chase pumps. They allocate based on mandates, models, and long‑term theses. As their share of ownership increases, Bitcoin’s volatility profile gradually shifts from speculative to structural. Drawdowns still happen, but they become liquidity events rather than existential crises.

The fourth shift is ownership transformation.

Bitcoin’s holder base is evolving from early adopters and retail traders to pension funds, sovereign wealth funds, RIAs, and asset managers. This doesn’t dilute Bitcoin’s ethos — it validates it. The asset built for sovereign individuals is now being accumulated by sovereign institutions.

ETF inflows are not noise.

They are the new foundation of Bitcoin’s market structure — a foundation built on long‑term capital, predictable demand, and irreversible supply absorption.

Sovereignty Lens — What This Means for Individuals

Institutional inflows are not just a market event — they are a sovereignty event. When the largest financial actors on the planet begin accumulating Bitcoin at record pace, it forces a deeper question: What does this mean for the individual who is trying to escape survival mode and build sovereign wealth?

The first truth is simple: institutions are now validating the thesis sovereign individuals acted on years ago.

For more than a decade, early adopters accumulated Bitcoin not because it was fashionable, but because it represented autonomy — an asset outside the reach of monetary policy, political cycles, and centralized control. Institutions are not buying Bitcoin for ideological reasons. They are buying it because the structural incentives have become undeniable.

The second truth is that the window for asymmetric advantage is narrowing, but not closed.

Institutions move slowly.

They allocate through committees, compliance departments, and quarterly cycles. Individuals move instantly. The sovereign individual still has the ability to front‑run institutional behavior, accumulate before supply tightens further, and position themselves ahead of the next liquidity cycle.

The third truth is that ETF inflows change the emotional landscape of Bitcoin ownership.

When institutions accumulate, volatility compresses. Drawdowns become less violent. The asset becomes more predictable. This is the environment where disciplined individuals thrive — not by trading, but by holding through structural shifts that others only recognize in hindsight.

The final truth is the most important: sovereignty is not granted by institutions — it is reclaimed by individuals.

Institutions accumulating Bitcoin does not diminish its role as a tool for personal autonomy. It amplifies it. Every inflow is a signal that the world is moving toward a new monetary reality, and individuals who understand this early are the ones who benefit most.

ETF inflows are a macro event, but their implications are deeply personal. They redefine what it means to build sovereign wealth in a world where institutions are finally catching up.

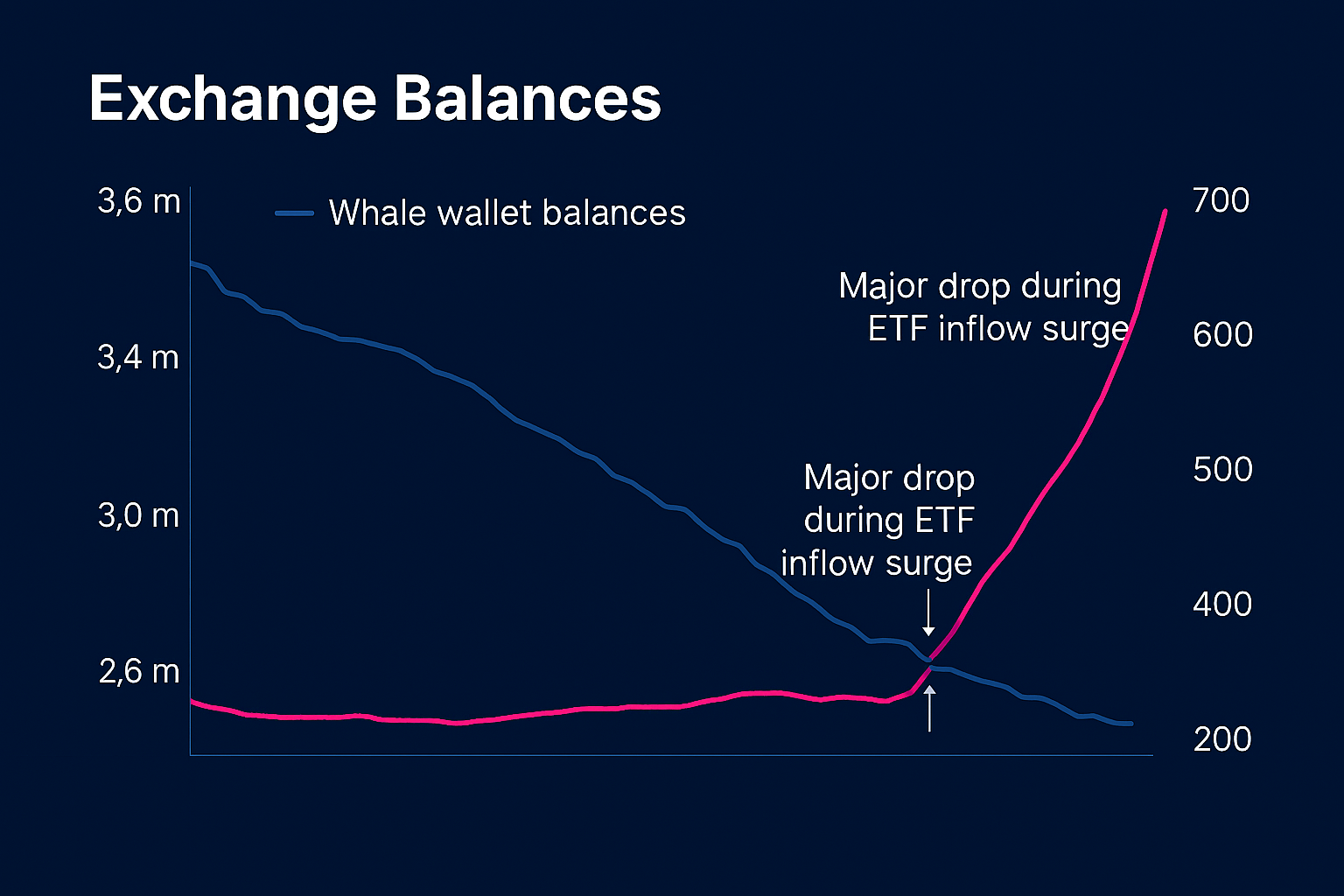

On‑Chain Confirmation — Whale Behavior and Accumulation Patterns

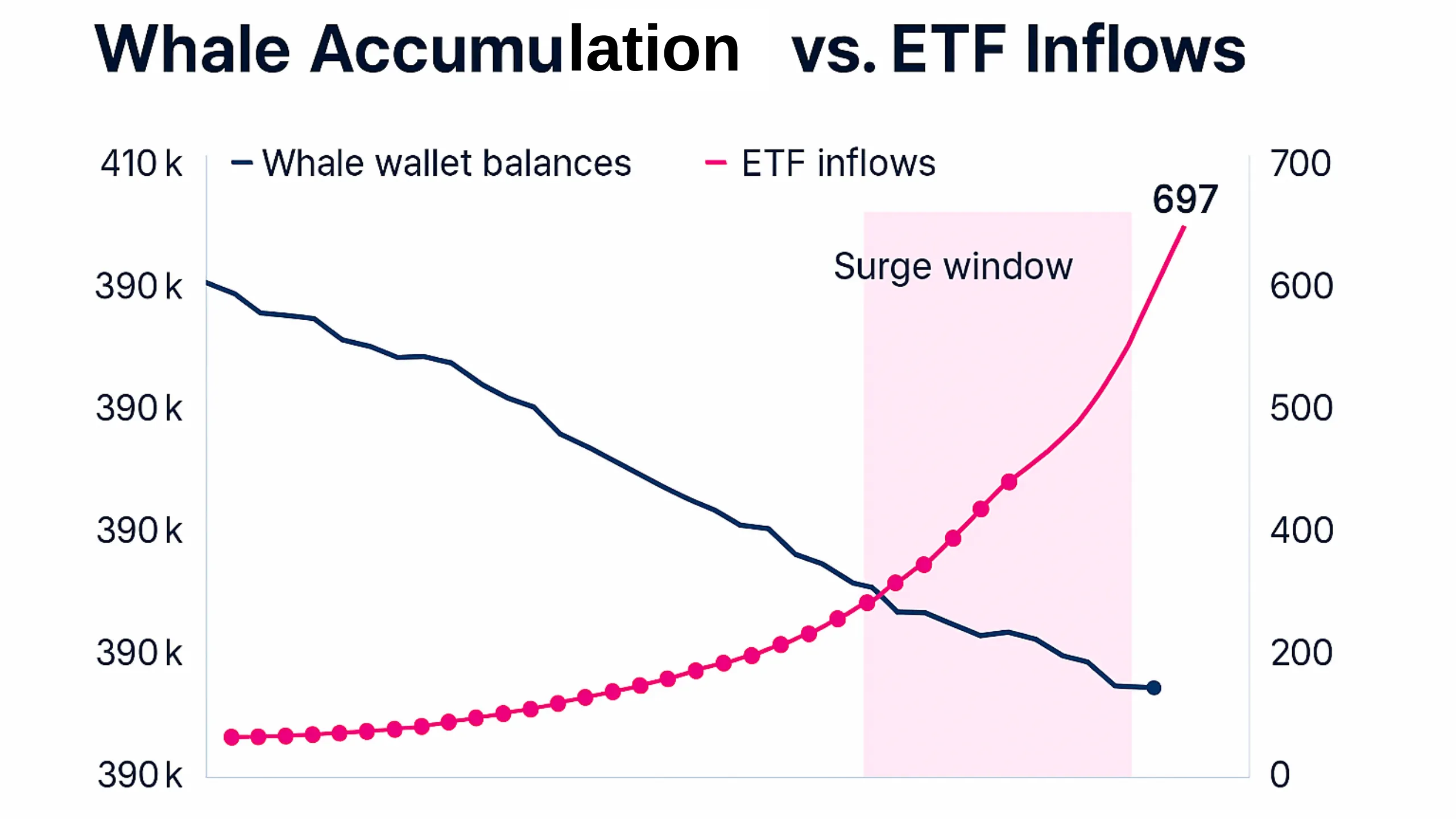

ETF inflows tell one side of the story. On‑chain behavior tells the other. When both align, you’re no longer looking at sentiment — you’re looking at structural conviction. Over the last twenty days, the on‑chain data has delivered a clear message: large holders are repositioning, and their behavior mirrors the institutional surge happening in the ETF market.

The most striking signal is the rebound in whale balances, which jumped more than 20% after the fastest sell‑off since 2023. This pattern is familiar to anyone who studies Bitcoin’s long‑term cycles: whales reduce exposure during periods of overheated retail speculation, then quietly re‑accumulate when liquidity deepens and institutional demand strengthens.

The timing of this rebound — directly overlapping with record ETF inflows — is not coincidence.

It’s coordination.

Whales are not traders.

They are allocators.

Their movements reflect long‑term theses, not short‑term emotions. When whale wallets expand during a period of rising ETF demand, it signals a shared understanding among the largest holders: supply is tightening, and the next phase of accumulation has begun.

On‑chain data also shows a decline in exchange balances, continuing a multi‑year trend. Coins are flowing from liquid venues into long‑term storage, custodial vaults, and ETF cold wallets. This is the opposite of speculative behavior. It is the behavior of actors preparing for a future where Bitcoin’s available supply becomes increasingly scarce.

Even miner behavior reinforces the trend.

Hashrate remains near all‑time highs, miner reserves are stabilizing, and forced selling has decreased. Miners — the closest thing Bitcoin has to “insiders” — are signaling confidence through their willingness to hold inventory rather than liquidate it.

When ETFs absorb supply and whales accumulate simultaneously, the market is no longer driven by noise. It is driven by structure. And structure is what determines the next decade, not the next headline.

The Global Angle — Bitcoin as a Sovereign Asset

Bitcoin’s rise is not confined to Wall Street or U.S. ETF flows. The last twenty days have shown something far more consequential: Bitcoin is becoming a sovereign asset on the global stage — a tool nations, populations, and institutions use to navigate instability, sanctions, inflation, and capital controls. The ETF inflows are the institutional expression of a trend that has been unfolding worldwide for years.

Across emerging markets, Bitcoin is no longer treated as a speculative instrument.

It is treated as an escape valve.

In countries facing currency devaluation, political upheaval, or restricted access to global financial systems, Bitcoin provides a parallel rail — a way to store value, move capital, and participate in global markets without relying on fragile domestic infrastructure.

This is not theory. It is lived reality.

In places where inflation erodes purchasing power, Bitcoin becomes a hedge. In regions where banking systems are unreliable, Bitcoin becomes a lifeline. In economies facing sanctions or capital restrictions, Bitcoin becomes a pressure release mechanism. These use cases are not ideological. They are practical. They are survival‑driven. And they reinforce Bitcoin’s role as a sovereign asset long before institutions ever touched it.

What’s happening now is convergence.

The same asset used by individuals in distressed economies is being accumulated by the largest asset managers in the world. The same tool used by citizens to escape monetary repression is being integrated into the portfolios of pension funds and sovereign wealth funds. The same protocol that empowers individuals is now being recognized by institutions as a strategic reserve.

This is the global sovereignty shift: Bitcoin is no longer just a personal hedge — it is becoming a geopolitical instrument. ETF inflows are the institutional signal. Global adoption is the human signal. Together, they reveal a world quietly reorganizing around a neutral, borderless, censorship‑resistant asset.

What Comes Next — The 2026 Market Structure Outlook

The next phase of Bitcoin’s market structure is already taking shape. The record ETF inflows of the last twenty days are not an isolated surge — they are the opening signal of a new regime. To understand where Bitcoin is heading in 2026, you have to look at the forces now locked into place: structural demand, shrinking supply, institutional competition, and a global environment that increasingly rewards assets outside traditional monetary control.

The first major shift ahead is the normalization of six‑figure Bitcoin.

As ETF inflows continue to absorb supply and whales re‑accumulate, the market is approaching a point where the $100K level transitions from psychological barrier to structural support. This isn’t a prediction — it’s a reflection of the supply‑demand mechanics now in motion. When long‑term capital dominates ownership, price floors become more durable.

The second shift is institutional reflexivity.

Once Bitcoin becomes a performance driver for major asset managers, the incentives change. Underperformance relative to peers becomes a career risk. This creates a competitive loop: inflows drive performance, performance drives more inflows, and the cycle reinforces itself. Bitcoin becomes not just an allocation — it becomes a benchmark.

The third shift is global integration.

As more countries face inflation, capital controls, or geopolitical instability, Bitcoin’s role as a neutral settlement asset expands. This global demand doesn’t move in lockstep with U.S. ETF flows, but it amplifies them. The world is converging on Bitcoin for different reasons, but the result is the same: structural adoption.

The fourth shift is market maturation.

With ETFs anchoring liquidity and institutions shaping price discovery, Bitcoin’s volatility profile will continue to evolve. Drawdowns will still occur, but they will increasingly resemble liquidity resets rather than existential shocks.

The 2026 outlook is defined by one truth:

Bitcoin is entering its institutional era, and the market structure is reorganizing around that reality. The sovereign individual and the sovereign institution are now operating on the same playing field — and the next decade will be shaped by how both respond to this new equilibrium.

Closing Doctrine — Proof‑of‑Institutional‑Work

The last twenty days have delivered something far more important than bullish price action or headline excitement. They have delivered proof‑of‑institutional‑work — the moment when the world’s largest financial actors began behaving exactly as the sovereign individual has behaved for more than a decade. Not out of ideology. Not out of rebellion. But out of necessity.

Institutions are not early adopters. They are late validators.

They move only when the structural incentives become overwhelming, when the risk of ignoring an asset becomes greater than the risk of adopting it. Their record inflows into Bitcoin ETFs are not a bet. They are an admission — that the monetary system is shifting, that scarcity matters, and that Bitcoin has crossed the threshold from experiment to infrastructure.

For individuals, this is not a moment to be intimidated by institutional scale.

It is a moment to recognize the accuracy of the sovereign thesis. The systems you’ve been building — disciplined accumulation, long‑term positioning, operational sovereignty — are now being mirrored by the very institutions that once dismissed Bitcoin entirely.

Their participation does not diminish your sovereignty.

It amplifies it.

The doctrine is simple: institutions are now doing the work that sovereign individuals began. They are absorbing supply, anchoring liquidity, and validating Bitcoin’s role in the global financial system. But sovereignty is not something institutions can grant. It is something individuals claim through discipline, structure, and long‑term conviction.

The flood has begun.

The architecture is shifting. And the individuals who understand this moment — not as hype, but as structure — are the ones who will define the next era of digital asset sovereignty.